Putting You First: A Backwards Approach to Budgeting

25 Jul 2024

When it comes to managing personal finances, traditional budgeting methods can often feel restrictive and complicated. Enter “backwards budgeting,” a different approach that flips conventional budgeting on its head. This strategy emphasizes paying yourself first, starting to invest at a young age, and harnessing the power of compounding to build long-term wealth. Let’s explore these key principles and how they can pave the way to financial freedom.

The Concept of Backwards Budgeting

Backwards budgeting is a proactive financial strategy where you prioritize savings and investments before addressing other expenses. Instead of allocating what’s left after spending, you allocate a portion of your income to savings and investments right from the start. This method helps you work towards your financial goals and avoid the common pitfall of overspending.

Pay Yourself First

The cornerstone of backwards budgeting is the principle of paying yourself first. This means setting aside a predetermined amount of money for savings and investments before paying any bills or making any discretionary purchases. By prioritizing your financial future, you create a disciplined approach to building wealth.

Why It Matters:

- Consistent Savings: By automatically transferring a portion of your income to savings and investments, you make saving a non-negotiable habit.

- Reduce Impulse Spending: When savings are prioritized, you’re less likely to spend money impulsively since you have less disposable income available.

Start Investing at a Young Age

One of the most significant advantages of backwards budgeting is the emphasis on early investing. The sooner you start investing, the more time your money has to grow, thanks to the power of compounding.

The Power of Early Investing:

- Time is Your Ally: Starting early allows your investments to compound over a longer period. Even small contributions can grow significantly over time.

- Reduced Financial Pressure: Early investments can lead to substantial growth, reducing the need to make large contributions later in life.

A Practical Example

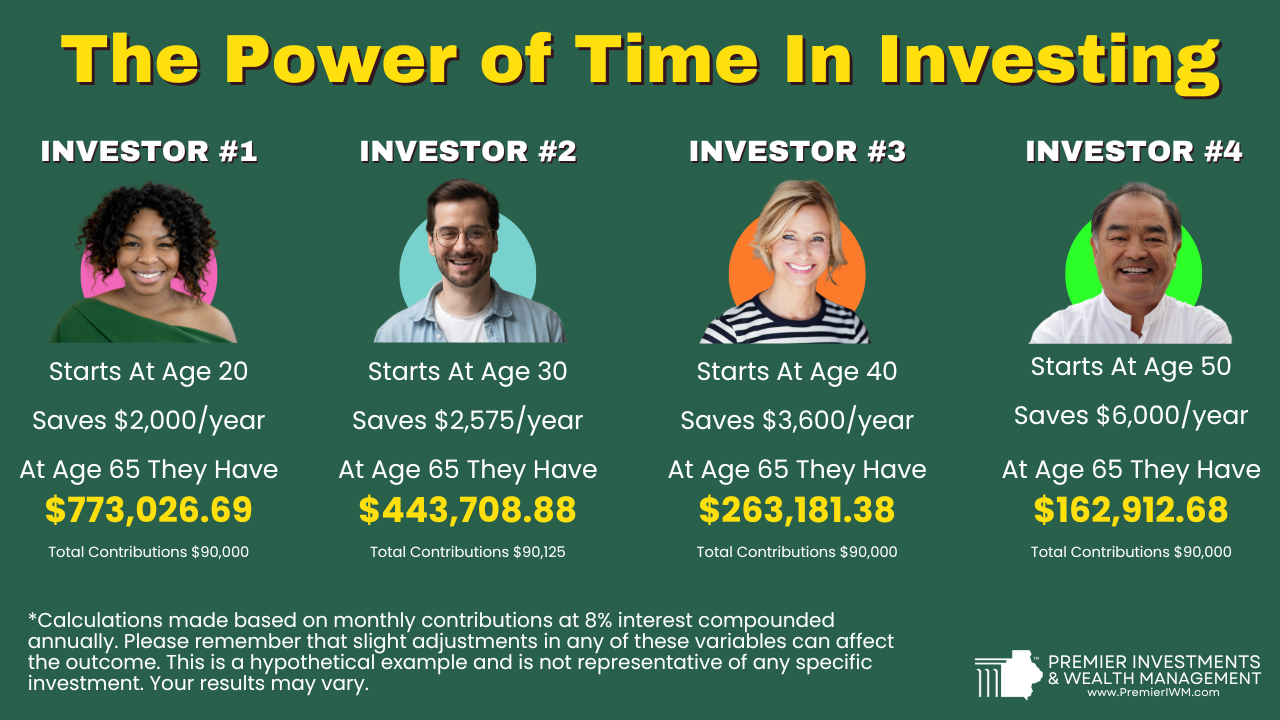

Consider four investors who begin investing at ages 20, 30, 40, and 50, respectively. Each makes consistent monthly contributions to their retirement plan. Despite each saver contributing a total of $90,000 over their investment period, the outcomes vary dramatically due to the power of compounding interest.

Implementing Backwards Budgeting

Implementing Backwards Budgeting

To adopt backwards budgeting, follow these steps:

- Determine Savings Goals: Identify short-term and long-term financial goals. This could include building an emergency fund, saving for a home, or investing for retirement.

- Automate Savings and Investments: Set up automatic transfers to savings and investment accounts immediately after receiving your paycheck.

- Adjust Spending Habits: With savings and investments prioritized, adjust your lifestyle and spending habits to live within the remaining budget.

- Review and Adjust: Regularly review your budget to help ensure it still aligns with your financial goals. Adjust contributions as your income and circumstances change.

Conclusion

Backwards budgeting is a powerful strategy that prioritizes your financial future by paying yourself first, starting to invest at a young age, and leveraging the power of compounding. By adopting this approach, you can build a solid foundation for long-term financial success and achieve your financial goals with greater ease and confidence.

Important Information

Securities and advisory services offered through LPL Financial, a registered investment advisor, Member FINRA/SIPC.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

All investing involves risk including the possible loss of principal. No strategy assures success or protects against loss.