The Premier Bucket Strategy

10 Jul 2024

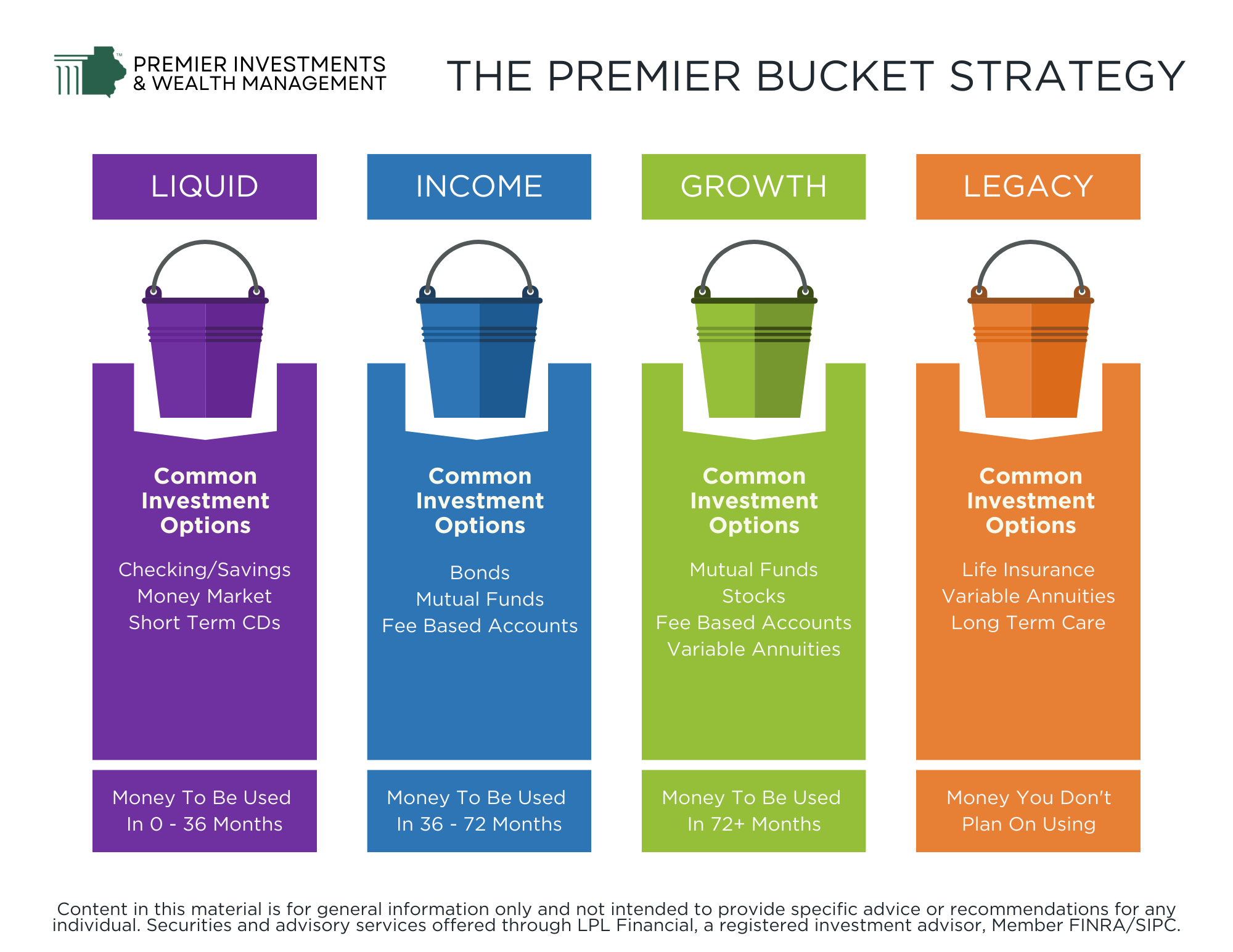

Planning is essential as you make the transition from accumulating assets to creating a retirement income stream. One powerful approach that can help you visualize how your investments are working for you during this process is the Premier Bucket Strategy. This strategy divides your investments into four distinct categories or “buckets,” each tailored to specific financial needs and time horizons. Let’s delve into each bucket and explore how this strategy can benefit you.

1. Liquid Bucket

Purpose: Immediate Access to Funds

The Liquid Bucket is designed for funds that you might need in the near future, typically within the next 0 to 36 months. This bucket focuses on maintaining high liquidity and low market risk, allowing you to access your money quickly without significant loss of value.

Common Investment Options:

- Checking/Savings Accounts

- Money Market Accounts

- Short Term Certificates of Deposit (CDs)

These investment options provide easy access to your funds while offering modest returns. They are ideal for emergency savings, short-term expenses, or upcoming major purchases.

2. Income Bucket

Purpose: Medium-Term Financial Needs

The Income Bucket caters to your financial needs over the medium term, usually within 36 to 72 months. This bucket aims to provide a steady stream of income while balancing risk and return.

Common Investment Options:

- Bonds

- Mutual Funds

- Fee-Based Accounts

These options offer relatively stable returns and lower volatility compared to equities. They are suitable for expenses that you anticipate in the near future, such as education costs, a new car, or home renovations.

3. Growth Bucket

Purpose: Long-Term Growth

The Growth Bucket is intended for investments that you won’t need to access for at least 72 months or more. This bucket focuses on capital appreciation and is suitable for long-term goals like retirement.

Common Investment Options:

- Mutual Funds

- Stocks

- Fee-Based Accounts

- Variable Annuities

Investing in growth-oriented assets provides the potential for higher returns, albeit with increased risk. This bucket is designed to outpace inflation and grow your wealth over time.

4. Legacy Bucket

Purpose: Long-Term Security and Legacy Planning

The Legacy Bucket is for funds that you don’t plan on using in your lifetime. Instead, these funds are intended to preserve your legacy, provide for your heirs, or support charitable causes.

Common Investment Options:

- Life Insurance

- Variable Annuities

- Long-Term Care Insurance

These investments focus on wealth preservation and protection, and create a financial legacy that remains intact and benefits future generations or causes that matter to you.

Implementing the Premier Bucket Strategy

To implement the Premier Bucket Strategy effectively, it’s crucial to regularly review and adjust your investment allocations based on your financial goals, market conditions, and changing life circumstances. Working with a financial advisor can help you tailor this strategy to your unique needs and better position your investment portfolio for long-term success.

Conclusion

The Premier Bucket Strategy offers a structured and flexible approach to managing your investments. By categorizing your assets into Liquid, Income, Growth, and Legacy buckets, you can align your financial planning with your time horizons and goals. A Premier Bucket Strategy helps you balance risk and return in your retirement income strategy.

Embrace the Premier Bucket Strategy today and take control of your financial journey with confidence and clarity.

Important Information:

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

Securities and advisory services offered through LPL Financial, a registered investment advisor, Member FINRA/SIPC.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

All investing involves risk including the possible loss of principal. No strategy assures success or protects against loss.

Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against loss.