We focus on your wealth.

You live your dreams.

Find Confidence.

Confidence comes from clarity, knowing where you stand and what might be missing. By taking a closer look at your financial picture, you can uncover potential gaps in areas like risk management or asset allocation that may be holding you back. Our goal is to help you make informed decisions with a clearer understanding of how each part of your plan supports your long-term goals.

Who We Serve

-

MEDICAL PROFESSIONALS

As a medical professional, your time is dedicated to helping others. Working with a financial professional can help you create a strategy to manage your finances, plan for the future, and make informed decisions based on your individual goals and circumstances.

-

BUSINESS OWNERS

As a business owner, you're constantly balancing growth, operations, and long-term vision. Partnering with a financial professional can help you develop a personalized strategy to manage your business and personal finances, plan for the future, and make informed decisions.

-

EXECUTIVES

As an executive, your responsibilities are complex and your time is limited. Working with a financial professional can help you navigate equity compensation, tax planning, and long-term financial goals with a strategy tailored to your unique situation.

-

UNION MEMBERS

As a union member, you've worked hard to earn valuable benefits. Partnering with a financial professional can help you understand your pension options, navigate your retirement benefits, and create a financial plan that supports your goals now and in the future.

-

RETIREES

As a retiree, your focus shifts from building your savings to making them last. Working with a financial professional can help you create a retirement income strategy designed to align with your lifestyle, manage risks, and support your financial goals throughout retirement.

-

HIGH NET WORTH

As a high net worth individual, your financial decisions often involve added complexity. Partnering with a financial professional can help you navigate tax strategies, estate planning, and charitable giving with a personalized approach that aligns with your values and helps you manage and transfer wealth intentionally.

Focus. Plan. Thrive.

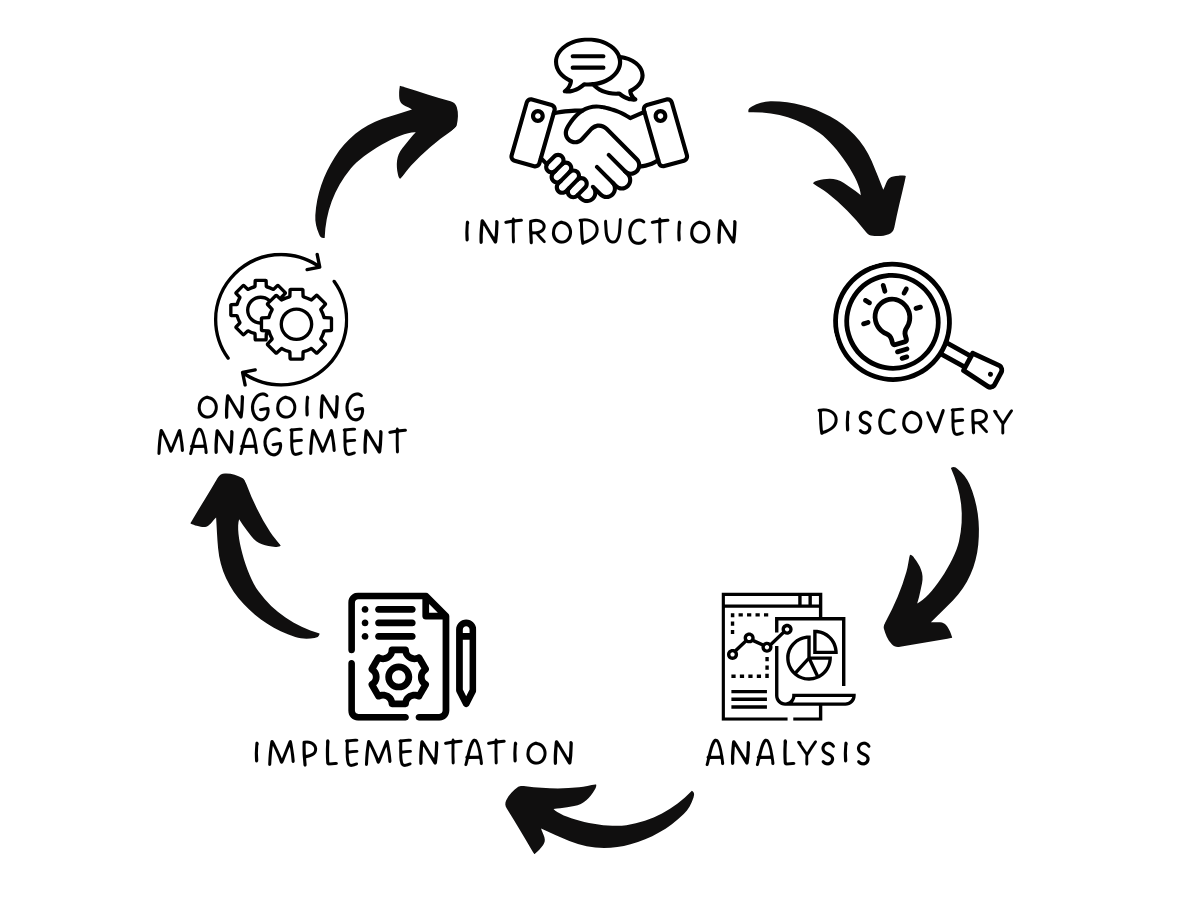

Our financial planning process designed to help you gain clarity around your financial goals and make informed decisions as your life evolves.

Introduction: It begins with a conversation. This initial meeting allows you to learn more about our approach and share what’s important to you—your financial goals, values, and any concerns you may have.

Discovery: We work with you to gather and organize information about your current financial situation, including income, assets, liabilities, risk tolerance, and long-term objectives. This step helps identify areas that may need attention.

Analysis: Using the information you provide, we evaluate your financial picture to develop a personalized strategy. This may include considerations related to retirement planning, risk management, tax planning, and other financial goals based on your individual circumstances.

Implementation: After reviewing and discussing the strategy with you, we assist with taking the appropriate steps to put your plan in motion. We can also coordinate with your existing tax or legal professionals if needed.

Ongoing Management: Financial planning is not a one-time event. We offer ongoing support to help you monitor progress, adapt to life changes, and make adjustments to your strategy as needed.