Make the Transition from Working

to Living With Confidence

Retirement isn’t the end of the journey. It’s a new beginning—and how you plan to generate income in retirement can make all the difference. We help you shift from saving to living with purpose and financial clarity.

Planning for What’s Next

You’ve spent decades working hard and saving diligently. But retirement brings a new challenge: How do you turn your savings into income that lasts?

At Premier Investments & Wealth Management, we specialize in helping clients make that transition smoothly—so your retirement years can be about freedom, not financial stress.

Whether retirement is five years away or fast approaching, the time to plan for distribution is now.

It’s Not Just What You Have, It’s How You Use It

A successful retirement strategy isn’t just about the size of your nest egg. It’s about how, and when, you draw from it. That’s where income planning comes in.

We help you:

✅ Turn your investments into income streams

✅ Manage taxes in retirement

✅ Analyze Social Security and Pension decisions

✅ Balance liquidity needs with longevity needs

✅ Plan for healthcare and long-term care costs

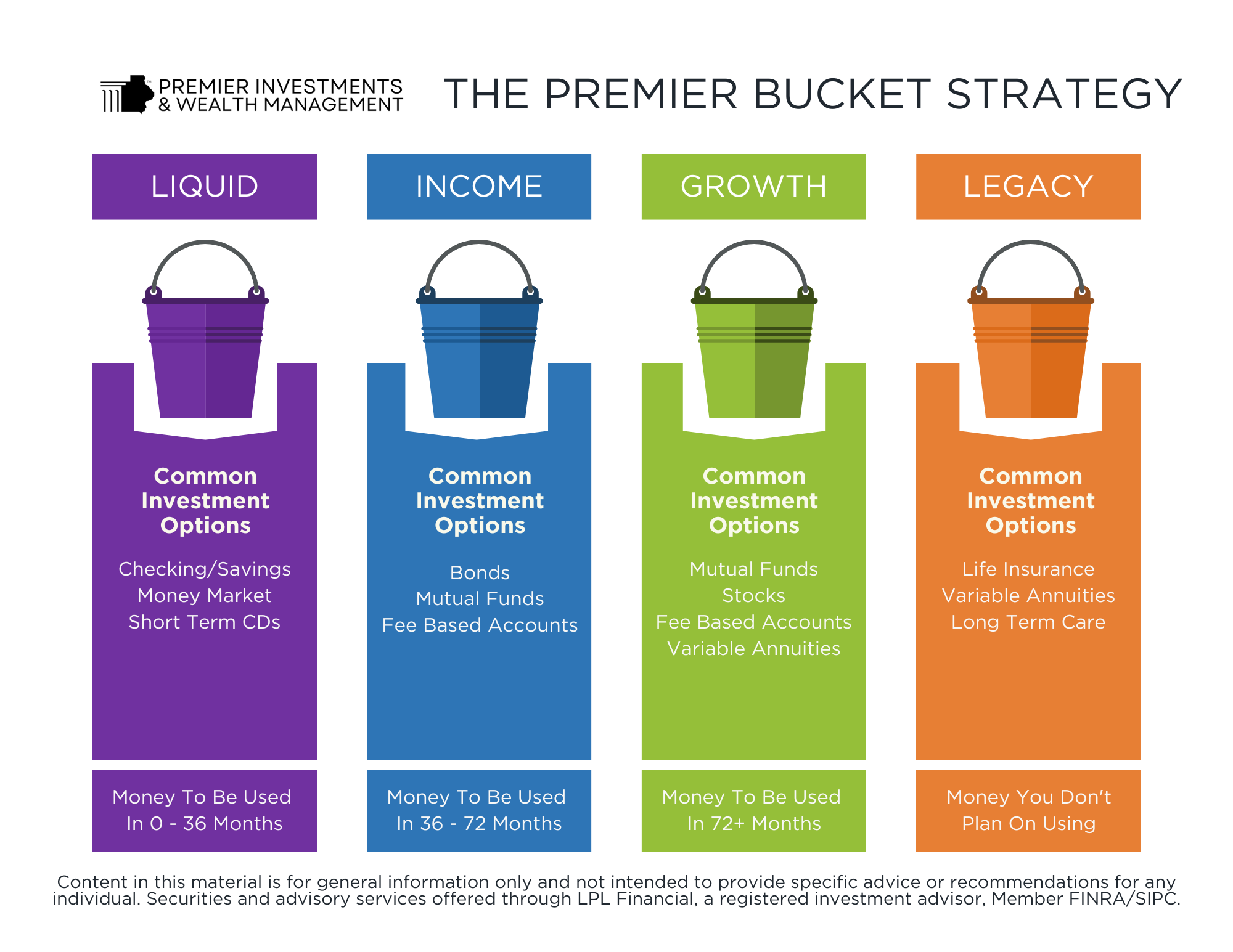

The Premier Bucket Strategy

We use the Premier Bucket Strategy—a disciplined, goals-based approach to managing your retirement assets. It’s built around timing and purpose, dividing your money into four distinct “buckets” based on when you’ll need it.

Your needs, priorities, and lifestyle may change over time—and your retirement plan should adapt with you. We’re here to walk beside you; not just into retirement, but through it.