5 Moves To Make Now If You Plan to Retire in 2025

02 Oct 2024

Retirement is a significant milestone, especially if you’re just a year away from reaching your financial freedom. While the excitement of no longer working can feel liberating, it also comes with financial responsibilities that require careful planning. With 2025 on the horizon, there are key financial steps you can take now to help with the transition into this new chapter of life.

Reassess Your Retirement Budget

By now, you probably have a general idea of how much you’ll need to live on during retirement, but it’s time to refine that plan. Start by reviewing your estimated living expenses, factoring in inflation, healthcare costs, and any plans you have for travel or hobbies. Consider what your day-to-day spending will look like and adjust accordingly.

Key Areas to Focus on Include:

1. Healthcare: Medicare eligibility starts at 65, but if you’re retiring before then, consider your healthcare options.

2. Housing: Will you downsize or stay put? If you’re still carrying a mortgage, account for that in your budget.

3. Lifestyle costs: Travel, leisure activities, and family obligations can add up. Make sure your budget reflects how you truly want to spend your retirement years.

Maximize Retirement Contributions

With just a little time left before retirement, now is the time to take full advantage of contribution limits for retirement accounts. For 2024, the IRS allows individuals over 50 to contribute an extra amount through “catch-up” contributions. Here’s what you should consider:

401(k) or 403(b): The catch-up contribution limit is $7,500 on top of the regular contribution limit of $23,000 for those under 50. That’s $30,500 you can stash away in tax-advantaged accounts.

Traditional or Roth IRA: You can contribute an additional $1,000 over the regular $7,000 contribution limit, bringing your total to $8,000.

Maximizing these contributions can give your retirement savings a final boost before you begin taking income from your investments.

Reduce Debt Before You Retire

Entering retirement with debt can drain your savings quicker than expected. As you approach your retirement date, prioritize paying down any high-interest debts, like credit card balances or personal loans, and even consider paying off your mortgage if it fits into your financial strategy. By reducing or eliminating debt, you’re giving yourself more room to enjoy retirement without the burden of monthly payments.

Strategies to Reduce Debt:

Pay off high-interest debt first, such as credit cards or personal loans.

Refinance any remaining debt at lower interest rates if possible.

Create a realistic debt repayment plan that aligns with your retirement timeline.

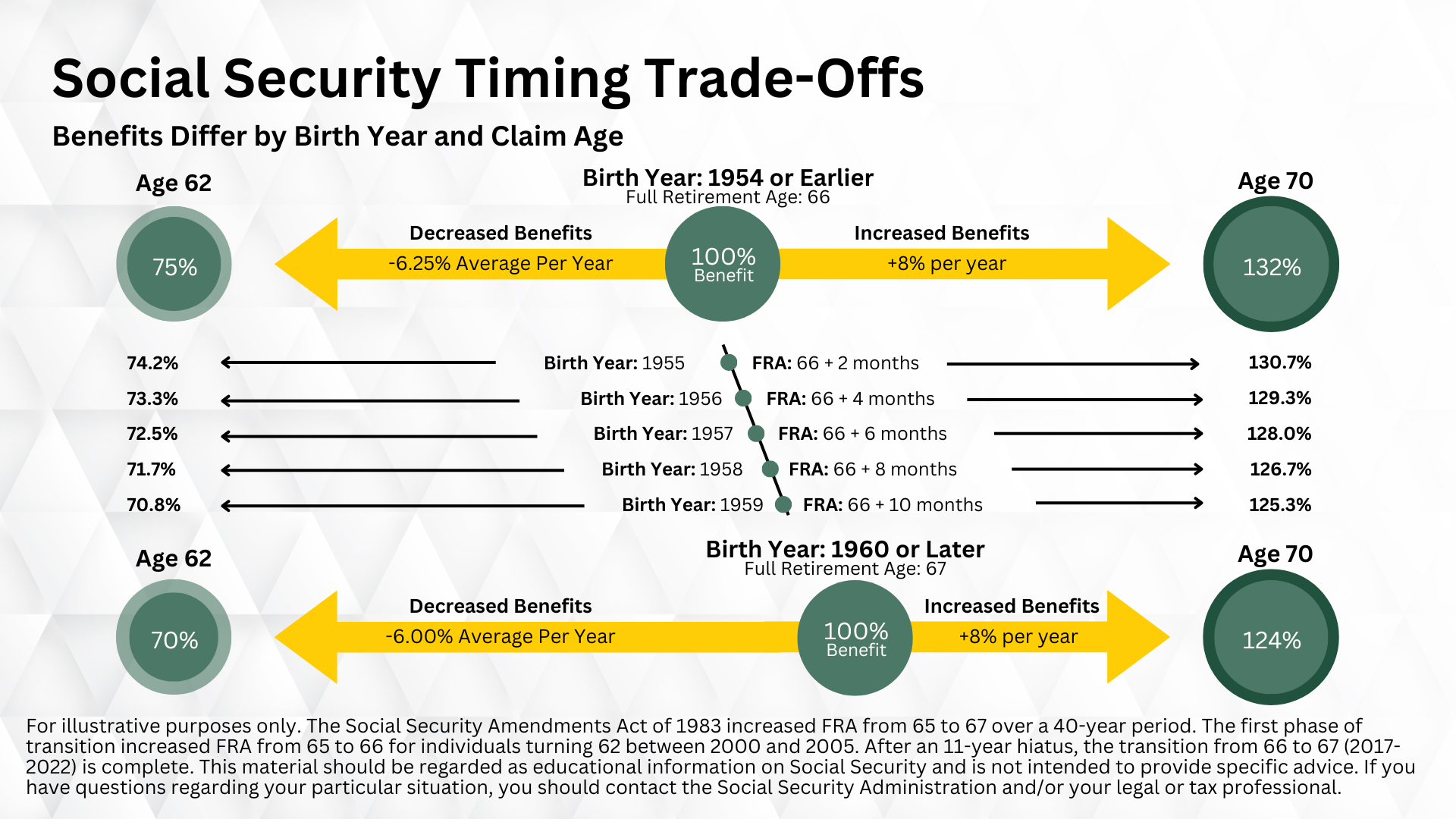

Evaluate Your Social Security Strategy

Social Security plays a critical role in your retirement income, and deciding when to start collecting is crucial. If you claim benefits early at age 62, you’ll receive a reduced amount, but if you delay until age 70, you’ll increase your benefit. Since you’re planning to retire in 2025, evaluate whether you need to start collecting immediately or if delaying is feasible for your financial situation.

Key Social Security Considerations:

1. Full retirement age (FRA): Determine your FRA based on your birth year to see how claiming before or after affects your benefits.

2. Married couples: Consider strategies for maximizing benefits based on spousal and survivor benefits.

3. Other income sources: If you can draw from your retirement accounts for a few years, you might delay claiming Social Security to receive higher monthly payments later on.

Review Your Investment Portfolio and Asset Allocation

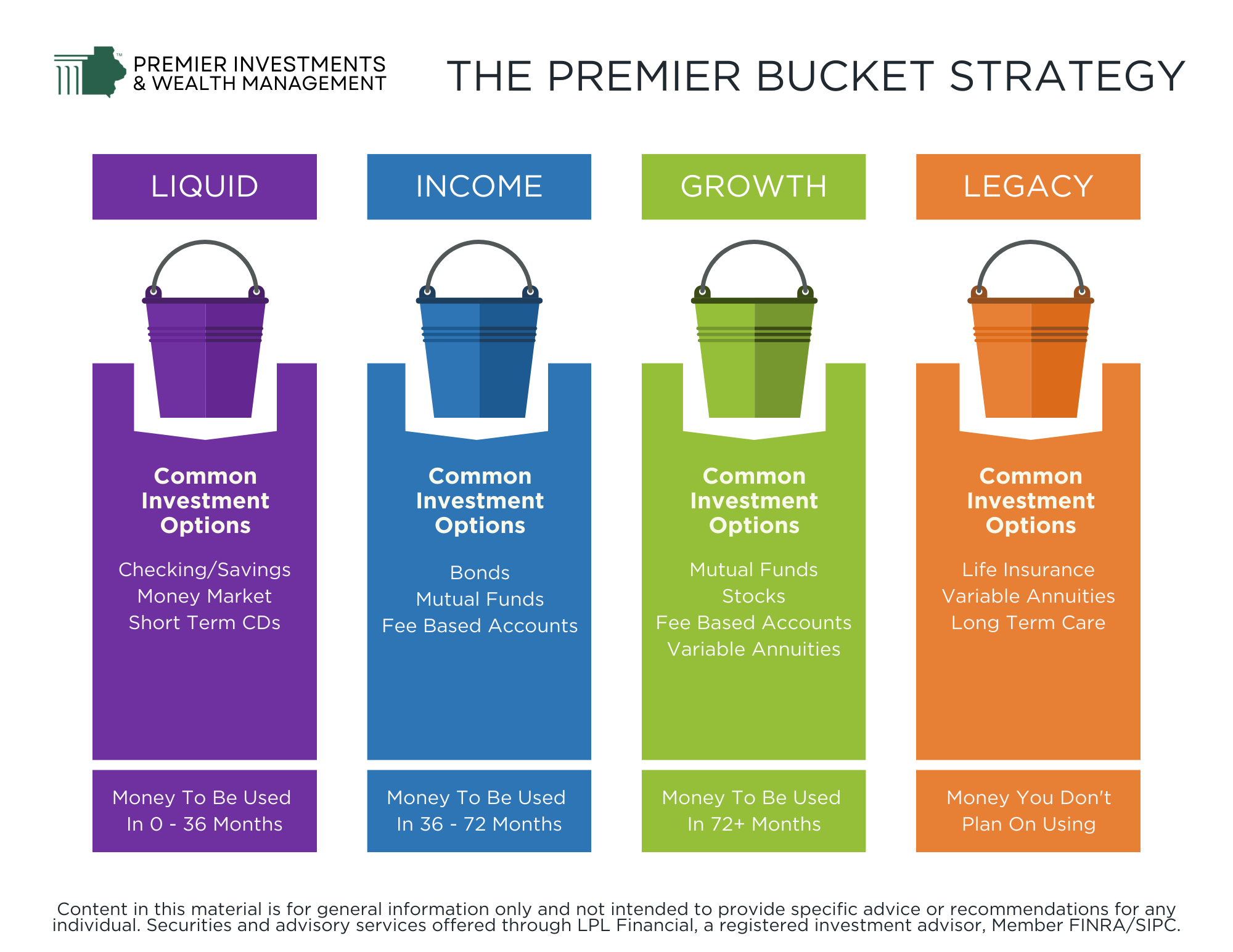

Transitioning from accumulating to distributing and preserving wealth takes planning. You don’t want to face a significant market downturn right after retiring, so developing an income strategy and asset allocation that aligns with your retirement goals is important.

We utilize the Premier Bucket Strategy with our clients to help them assign responsibility to their money in retirement.

The Liquid Bucket consists consists of money (usually 1 to 3 years of living expenses) that is in cash or cash alternatives. This is the money you will use to live on in the short term.

The Income Bucket consists of investments that help generate income to replenish your cash reserves overtime.

The Growth Bucket is your long-term money. Remember, retirement is not a destination, but a 30+ year journey. Keeping some assets focused on growth can help you manage longevity risk.

The Legacy Bucket is an optional bucket. This would consist of money that you plan on leaving to your heirs or charity after you are gone. For some people, this is an important piece of their overall financial puzzle, and for others, it isn’t.

If you’re planning to retire in 2025, these financial moves can set the stage for a smooth transition to retirement. By reassessing your budget, maximizing contributions, reducing debt, evaluating Social Security strategies, and adjusting your investment portfolio, you’ll be better positioned to enjoy the retirement you’ve worked so hard for. Time may be short, but with careful planning, you can ensure your financial house is in order as you move into this exciting new phase of life.

Important Information:

Securities and advisory services offered through LPL Financial, a registered investment advisor, Member FINRA/SIPC.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Consult your tax professional about eligibility to Roth and Traditional IRA contributions. Contributions and earnings in a Roth IRA can be withdrawn without paying taxes and penalties if the account owner is at least 59 ½ and has held their Roth IRA for at least five years.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

All investing involves risk including the possible loss of principal. No strategy assures success or protects against loss.